will capital gains tax increase be retroactive

The top rate for 2021 is 37 plus. The American Families Plans proposed tax rate of 434 on capital gains is the highest tax rate on long-term capital gains in the past 100 years and the largest increase in the long-term capital gains rate in US.

Retroactive Effective Date For Capital Gains Tax Increase Is A Bad Idea

President Joe Biden released his proposed 2022 fiscal year budget on Friday which calls for an increase of the top capital gains tax rate to 396.

. Posted June 10 2021. There is already some pushback among some congressional Democrats concerning the Presidents capital-gains tax plan. A Retroactive Tax Increase Biden wants to tax capital gains you made even before a bill passes.

Top earners may pay up to 434 on long-term. My guess is that since the Democratic majority is so thin there is little chance any tax increase will be made retroactive to January 1 2021. Qualify for long-term capital gains to five years for taxpayers with adjusted gross income of 400000 or.

He speaks on Bl. Perhaps the most newsworthy item in the Treasury Department Greenbook was the Biden Administrations proposal to increase taxes on capital gains on a retroactive basis. For taxpayers with income of over 1 million long-term capital gains will be taxed at ordinary rates.

At this point though its looking like the. Bidens budget calls for the increase in the top capital gains rate to be implemented retroactively. Bidens pre-election proposal advocated almost doubling the top tax rate on capital gains from the current 20 or 238 including the Medicare surtax to a rate equal to that for ordinary.

BIDENS PLANNED CAPITALS GAINS TAX HIKE COULD SLASH US REVENUE BY 33B. 2 Proposed Biden Retroactive Capital Gains Tax National axpayers Union ondation Could Be Challenged on Constitutional Grounds levying a 10 percent surtax on high earners6 imposing a one-time 25 percent wealth tax7 and imposing an annual 2 percent or 3 percent wealth tax8 One idea in play is a retroactive capital gains tax increase raising the top tax rate currently. Increase the facilitys construction cost by more than 25.

Oct26 -- Adam Sender founder of Sender Company Partners SCP discusses how he is positioning ahead of the 2020 presidential election. The Democrats proposed tax deduction for the rich puts the Vermont socialist and low. In order to pay for the sweeping spending plan the president called for nearly doubling the capital gains tax rate to 396.

The biodiesel and renewable diesel credit. To 489 percent up from 292 percent under current law and well-above the OECD average of 189 percent. This is a MAJOR change and may not be.

President Biden has proposed increasing the top 238 capital gain rate to 434 a staggering 82 increase. Then there is timing. The gross tax increase would be reduced on a net basis by increases in tax credits for certain individuals and economic activities.

Lets remember that Congress must still approve any changes in tax rates as well as any retroactive effective dates. As proposed the rate hike is already in effect for sales after. That a capital gain rate increase could be.

Taxing capital gains at ordinary income tax rates would bring the combined top marginal rate in the US. A historical review suggests that any tax legislation enacted in 2021 could have retroactive effect to transactions completed at any time in 2021. The later in the year that a Democratic tax bill if any is passed the less likely it will have any retroactive effect.

Versions of this article were published by Advisor Perspectives and. Many taxpayers who will be subject to this tax increase are likely to postpone recognition of capital gains longer than. All the US tax information you need every week.

Claims for tax credits during the period of retroactive eligibility. Perhaps had Congress looked to enact such changes earlier in 2021 the chance to make the capital gains tax changes retroactive to perhaps the start of the year would have been greater. The capital-gains tax rate increase from 20 to 396 would be retroactive to April 2021.

Specifically the Greenbook proposes to tax long-term capital gains and qualified dividends of taxpayers with adjusted gross income of more than 1 million at. All may not be lost.

Why This Entrepreneur Wants You To Be A Millionaire

Biden S Ex Post Facto Capital Gains Tax Increase Wsj

Understanding The Proposed Retroactive Capital Gains Tax Rate Increase Frazier Deeter Llc

Biden Wants To Limit The Capital Gains Tax Preference History Shows It Will Be Hard

R Rated Top Android App By Best Android App Review Bloomberg Bna S Handy Quick Tax Reference Guide Gives You Access T Medicaid Corporate Law Marketing Jobs

Biden Retroactively Doubles Capital Gain Tax But Keeps 10m Benefit

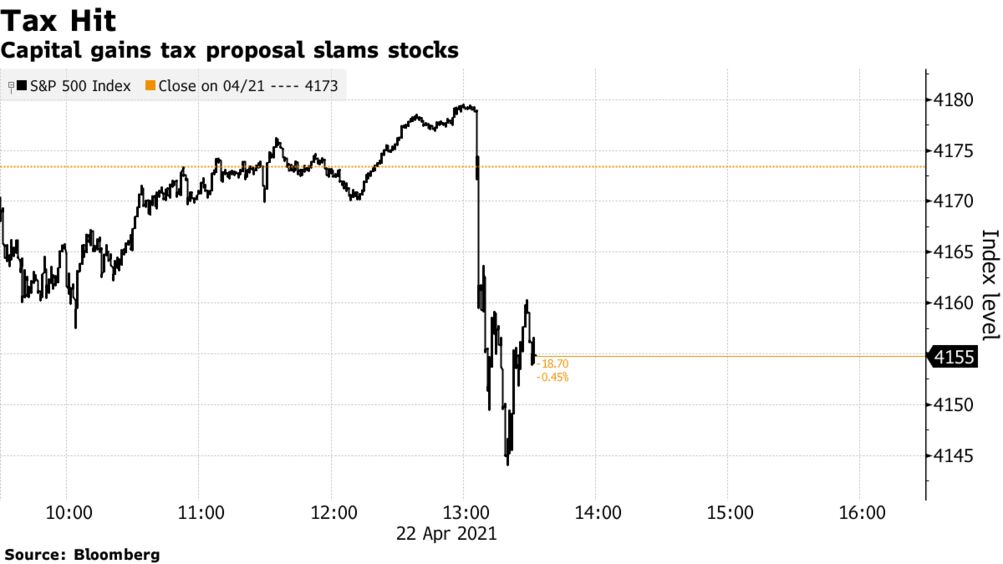

Wall Street On Tax Plan It Will Incentivize Selling This Year Bloomberg

House Democrats Propose Hiking Capital Gains Tax To 28 8

Biden Will Seek Tax Increase On Rich To Fund Child Care And Education The New York Times

Potential Changes To The Capital Gains Tax Rate Publications Foley Lardner Llp

Biden Budget Reiterates 43 4 Top Capital Gains Tax Rate For Millionaires

.png)

Biden S Green Book Includes Retroactive Capital Gains Tax Increase Husch Blackwell Llp Jdsupra

Private Equity Faces Increase In Capital Gains Tax Rate Our Insights Plante Moran

House Democrats Propose Hiking Capital Gains Tax To 28 8

Biden Tax Proposals Highlights From The Green Book Retroactive Capital Gains Tax Increase And The Repeal Of The Step Up In Basis Among Others

Managing Tax Rate Uncertainty Russell Investments

Will Section 529a Plans Replace Special Needs Trusts Financial Advisory Financial Advisors Social Security Benefits

Biden Tax Proposals Highlights From The Green Book Retroactive Capital Gains Tax Increase And The Repeal Of The Step Up In Basis Among Others